Disclaimer, NFA, all that legal stuff: All the information presented on this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.

Hi folks,

This is going to be a relatively short issue as we’re preparing for significant changes to the publication in the upcoming weeks - fingers crossed!

DAO is a mess. A few days ago, TRIBE DAO, one of the most notable DeFi DAO in the crypto space announced its intention to shut down. Maybe I’m a young boomer, but optimizing for accountability and effectiveness is extremely difficult when something is “autonomous”. Perhaps a good idea for decentralized financial mechanisms, but an extremely bad idea for builders.

What DAO Hell Is Going On?

DAO stands for Decentralized Autonomous Organization.

A bottoms-up organizational entity instead of the conventional top-to-bottom hierarchy. There’s no centralized authority and decisions are being made as a collective. Tokenholders participate in the management by voting on proposals that can change certain parameters in the protocol associated with the DAO. The original smart contracts written laid the foundations for what can and can’t be changed.

Inspired by the original crypto ethos of decentralization, DAO aims to create a crypto-native structure that fits this ideology. It also reduces regulatory risks as a properly working DAO means that it is self-sustaining without a penultimate owner or decision maker. There’s no CEO to dictate the trajectory of the DAO, nor a Board of Directors to oversee management.

At a glance, this organizational structure sounds like a good idea. It aligns with the original crypto ethos and includes added benefits. Imagine if Uber shareholders can change the ride-hailing fees and the surge pricing algorithm by voting on governance proposals. Imagine if there’s no CEO so Uber could’ve just continued subsidizing cheap rides via distributing more UBER shares as liquidity-driving rewards. Imagine if Dara Khosrowshahi never made the decision to double down on Uber eats and made the company profitable. Imagine how long it would take to achieve all of this with a bottoms-up approach. Oh, wait… now it doesn’t sound that good anymore.

I know that DAO is still experimenting with various governance structures; but for now, it seems to be mimicking what’s good about equity shareholders’ voting power, but without the same level of effectiveness or regulatory oversight.

Achieving decentralization and autonomy with accountability is hard.

So how can DAOs improve? — in this write-up, we present frameworks to think about decentralized governance, and how to optimize good business decisions alongside it.

Here are the quick takeaways:

Decentralizing too fast or early is the number one mistake.

DAO insiders often create a “false narrative” that every decision is “the will of the community”.

Having a hierarchical structure in a DAO is not a bad thing.

A mature DAO probably looks a lot like a publicly traded company.

Accountability needs to be enforced on-chain.

False Narrative

The reality is that most DAOs are not decentralized or even autonomous. Original founders, core team members, and early investors can sway decisions to their own liking as majority token holders. The execution effectiveness of a DAO is not measured by its community members' participation, but mostly by how good the core team members are. Take a look at the Tribe DAO chain of events below.

In May, a proposal passed to reimburse the $80m Fuse hack (Fuse is a money market owned by Rari Capital, which was merged with Tribe DAO). Then, when the refund is about to be approved, a veto proposal was submitted to cancel the decision. Fei Labs, the main entity associated with Tribe DAO, decided to abstain from voting, which indicated that it was against the refund. All of this happened a few days after Jai Bhavnani, the original founder of Rari, decided to step down from his role. Fast forward a few months after, Joey Santoro, the original founder of Fei Labs, decided to wind down and step back from Tribe DAO.

If the last paragraph doesn’t make sense to you, consider yourself lucky.

Once again, instilling accountability in a DAO and its main operators is extremely difficult, especially when voting powers are concentrated on a select few, creating a “false narrative” that every decision is “the will of the community” — placing the blame on the tokenholders if it fails, but taking massive credits if it works.

You want a DAO to be mature and operate like Apple, whereby Tim Cook has real responsibilities and reports to the Board of Directors — not like Facebook, where you can’t fire Mark Zuckerberg’s Kid’s Kids.

DAOllar DAOllar Bill

DAO in its current form is also extremely inefficient. There’s absolutely no reason whatsoever why a crypto startup should become a DAO earlier in the day other than mitigating regulatory risks. The fact that it’s often combined with anonymous founders is also another pitfall.

If a FAANG engineer can juggle 10 remote jobs, do you think the following can’t happen?

Large DAOs are also quite generous with their budget. Maker has generated $75M in cumulative protocol revenue over the past 6 months but has an annual budget of ~$54M.

This means an average salary of ~$400,000/person, which is higher than NASA.

The point being is that DAO requires more accountability. In future posts, I’ll explore further how this can be done, but we should take an already working playbook from publicly traded companies instead of reinventing the wheel.

However, it should be enforceable on-chain.

Mechanisms such as milestones-based compensations on specific KPIs that can’t be gamed are a good example. Imagine a scenario whereby the original founders’ tokens are vested for 8 years (approximately the average time for a startup to go public) with certain percentages to be unlocked when clear milestones such as net profits, daily active users, and others are met. We can explore many other possibilities here, but the design needs to be tight-knitted, enforceable on-chain, and immune to gamification.

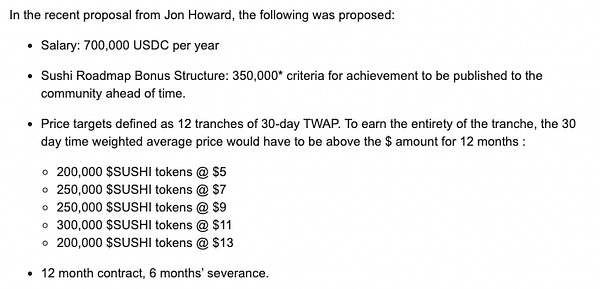

The following SUSHI head chef compensation is a good starting point, but I disagree with the token price-based compensations, especially when most protocols are at a relatively young age. Price-based compensations might work for public companies’ CEOs because of regulations and strict wash trading oversight. In crypto, this requires more nuanced thinking as market manipulations happen a lot more often.

Oh, and it also reminds us of how generous DAOs are.

P.S.D.

A Bear Stern memo from 1981 went viral in the past few years. It talks about creating a company culture of hiring PSD degrees. Poor, Smart, and a Deep desire to get rich. The crypto space is full of people who want to “make it”, but not many are approaching it with proper business acumen. Degenerate gamblers lost their money in JPEGs trading and grifter founders made their money via short vesting lockups. The average tenure of crypto founders is 18 months before they turn to angel investing.

While developers and blockchain technological advancements are important, the crypto space needs more business builders. Folks who want to prove that web 3.0 can generate useful products, disrupt the incumbents’ business model, and be rich in the process — without opting into unsavory tokenomics tactics to gain short-term riches.

Until next time,

Marco M.