The Token Endgame

How crypto assets will accrue value.

Disclaimer, NFA, all that legal stuff: All the information presented on this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.

Hi folks,

Welcome to the inaugural issue of Pensive Pragmatism, my blog about crypto, business, markets, and life musings in general. As the name suggests, I aim to provide measured and informational takes on relevant crypto topics, focusing on substance over hype. I’ll also be covering non-crypto topics (occasionally) as I have other interests too, but we’ll save that for later.

For the foreseeable future, the content of this publication will be 90% crypto.

I’ve been wanting to get back into writing long-form rather than a daily issue, especially because crypto topics are becoming too nuanced for a 3-min daily recap.

However, if that’s your cup of tea, kindly head over to my other newsletter, The Wagmi Journal.

The Token Endgame

In the past decade, we’ve witnessed the renaissance of a new asset class: tokens.

Now, whether or not you think there should be a differentiation between tokens, coins, digital assets, cryptocurrencies, etc — frankly, I don’t really care. The work of defining jargon and terminologies belongs to academics, lawyers, and regulators. I will gladly stay in my lane and pontificate on how this new asset class will create value. Alas, let’s get started.

For the rest of this write-up, I’ll refer to tokens as any crypto asset that is secured by a blockchain.

Here are the quick takeaways:

The endgame for tokens is to become “equity-like”, but with more use-cases.

Tokens will become the digital-native asset, more seamless and interoperable than all existing asset classes.

The regulatory environment will catch up to this new reality, but it will take time.

Values can’t accrue to both tokens & equities effectively.

The next crypto bull cycle requires tokens to integrate with real economic activities.

What is a token?

The emergence and popularity of digital tokens started approximately a decade ago when Bitcoin showed the world the possibility of having an entirely digital, cryptographically secured, immutable form of money that can be utilized by any party and is free from centralized powers.

Thanks to blockchain technology, for the first time in history, we have a truly digital-native asset that can capitalize on the growth of the internet and transcend geographical borders. From a glance, we can simply see how this will unlock enormous value and enhance the rate of globalization, especially as the global economy became much more intertwined in the past decade.

Fast forward to 2014, Ethereum came to the scene and pioneered the idea of a smart contract. This unlocked the possibility of creating decentralized applications and businesses on the blockchain. Eventually, the discovery of smart contracts becomes the bedrock of what we’re now calling Web 3.0. Additionally, in the past 5 years, particularly since 2017 when crypto penetrated mainstream awareness for the first time, innovations surrounding the use-cases of tokens have been evolving at a rapid pace.

However, these innovations still fail to address the #1 question that has been haunting the crypto market:

What does my token represent and how does it accrue value?

In this write-up, we present mental models and ideas to help existing projects, builders, and other industry participants think about the future of tokens and create the appropriate framework suited for their business model.

To properly follow along with this write-up, we first need to understand the various types of tokens that have emerged in the past decade, and how they are shaping the current crypto space.

Digital Currency

As the name suggests, a digital currency aims to become a form of money on the internet that people can use to transact with one another. It does not have any other features such as smart contracts functionality, nor does it represent any use-cases tied to a particular project.

While Bitcoin started as a “peer-to-peer electronic cash system”, its current form and narrative are nowhere near what the original whitepaper described. Don’t worry, I’m not in the cult of Roger Ver.

There are initiatives to make Bitcoin more useful via projects such as Lightning Network and Stacks, which will make it so much more than just a digital currency. At the same time, the primary investment narrative being conveyed is to treat BTC like digital gold, with proponents saying that it should go up in value over time thanks to its embedded scarcity.

Network/L1 Tokens

Ethereum pioneered the idea of using blockchain technology to write smart contracts, enabling the creation of decentralized applications. This unlocks an entirely new type of token that is used to power blockchain “networks”, often dubbed as “Layer 1 (L1) token”. L1 tokens are used to secure the underlying blockchain network it lives on, as well as being the de-facto currency that users and developers need to pay with when utilizing the blockchain and decentralized applications built on top of it.

For example, ETH is required as payment when one transfers tokens via the Ethereum blockchain. Likewise, ETH is also needed when developers or users interact with decentralized applications and execute smart contracts on the Ethereum blockchain.

Utility Tokens

As L1 tokens mature and multiple blockchain networks with smart contract capability emerge, the number of developers who are interested in building applications on top of these networks also increases. In 2017, we saw many projects raising funds via Initial Coin Offerings (ICOs) to build their own blockchain suited for specific use-cases. These ideas were often big and broad but without any detailed explanation of what sort of problems they are actually trying to solve. Sales pitches such as “the Ethereum of China”, and “blockchain for global supply chains” were being thrown around as people realized that it was extremely easy to raise capital via ICO. Alas, crypto projects circa the 2017 ICO boom era were often criticized for trying to find problems for an existing solution.

What came after was, unsurprisingly, a spectacular crash with ICO tokens falling 99% and hard-swept regulatory enforcement from agencies around the world, causing founders to be wary of raising capital via ICO. The outcome of this then contributed to the rise of crypto VCs, but that’s a post for another time.

However, during this era, we also witnessed the rise of utility tokens. Projects that brilliantly imbue utility to their tokens without building their own chains such as Basic Attention Token (BAT) and Binance Coin (BNB) saw some form of success and started the era of utility tokens — what is also often called as “application layer” projects.

Governance Tokens

Fast forward to 2020, application layer projects found product-market fit and massive success via Decentralized Finance. The DeFi 1.0 generation projects such as MKR, UNI, AAVE, COMP, and SNX were not building their own blockchain, but instead, were building decentralized financial services on top of the Ethereum blockchain and issuing their own tokens for multiple reasons and with multiple use-cases.

While these use-cases vary, the common thread that emerges post the DeFi summer of 2020 is the notion of governance token. Owners of these tokens can submit and vote on proposals that can dictate the future of the projects, such as changing the fees charged by the services, or using the projects’ revenue to buy back tokens from the open market. Granted, the degree of governance power imbued to token holders also varies amongst projects — but for the first time in crypto history, token holders have rights that are quite similar to equity shareholders.

However, the concept of governance token doesn’t seem to be enough.

“but much governance token”

Perhaps you’re familiar with the saying above that mocks governance token value, which was arguably made famous by DegenSpartan. In retrospect, the hentai enjoyer had more insights than most crypto fund managers and tweeted actionable insights for market participants.

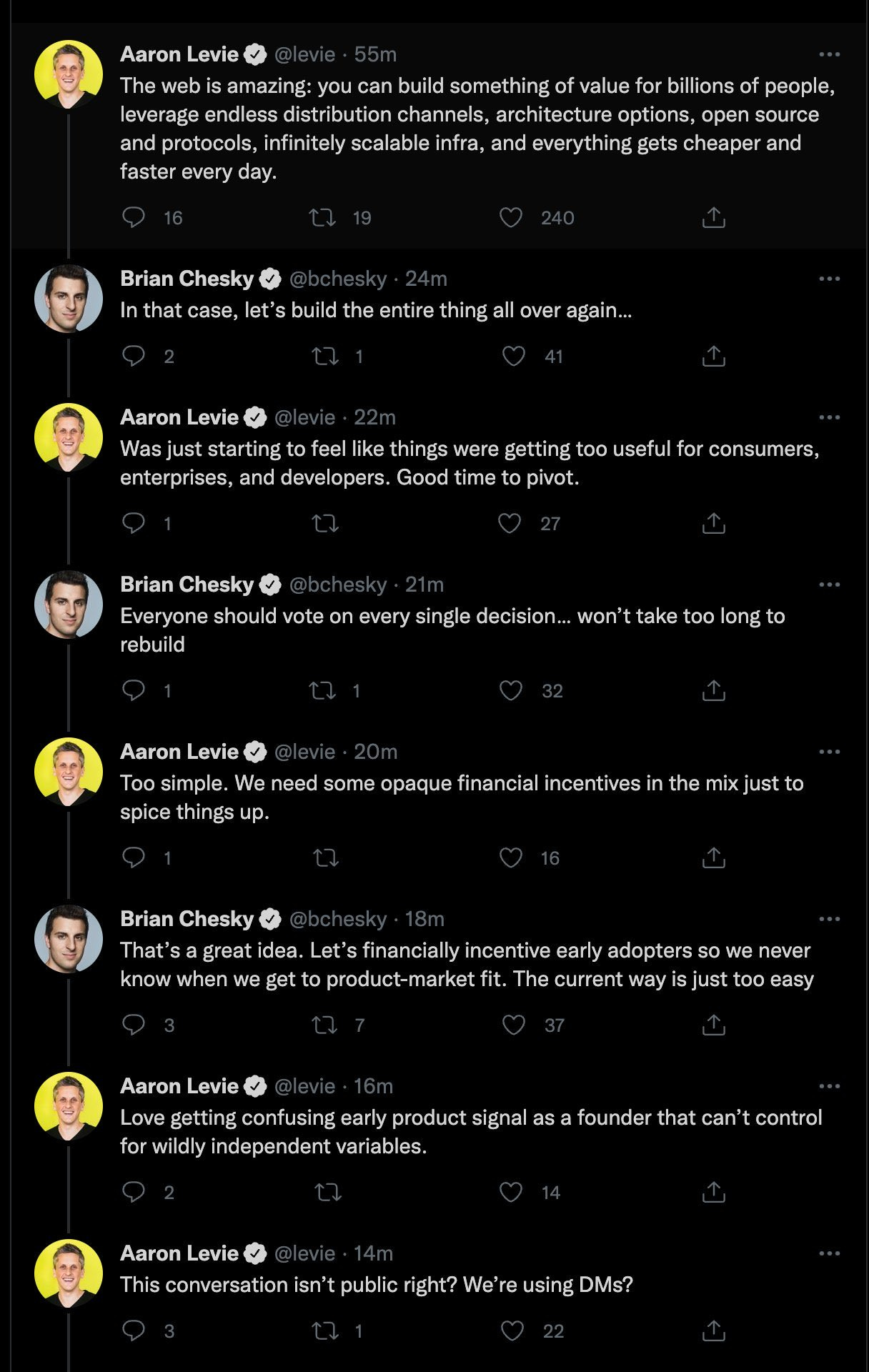

The chart below shows that despite Uniswap’s increasing revenue and user base, the price of UNI tokens does not reflect the growth at all. The Uniswap team had long touted that the fee switch, which will distribute part of the trading fee revenue to UNI token holders, will eventually be turned on. Expect to keep on waiting for any value to be accrued back to the UNI token as most of the Uniswap team resides in the US and the SEC is undergoing an investigation of Uniswap Labs.

But wait, these governance tokens’ price action is even worse when they are not Uniswap, the de-facto largest decentralized exchange in the crypto market with defendable moats such as first-mover advantage and proper security track records. Application layer projects who raised money without properly thinking about the defensibility of the use-cases of their tokens and simply relying on “governance power” suffered the most, especially altcoins raised on alternative L1 chains.

A few weeks ago, a Blockworks podcast episode piqued my interest as Richard Craib, the founder of the crypto project and quantitative hedge fund Numerai, explicitly stated (23:00 - 25:30) that what if we live in a world where the regulators allow us to raise capital via ICO and simply state that “yes, we’re raising this $ for a business”. Unfortunately, that would mean that it is a security, and the government would much rather let us raise capital for an art project or a weird governance token. To me, this candid take was incredibly refreshing, especially coming from someone who has been in the crypto space for quite some time and has a good understanding of both the tech and finance side of things.

okay, so we have established that having governance power is not enough, then how about all the x-to-earn models?

Ride-to-Earn (R2E)

Uber and other ride-hailing firms subsidized ride costs in their early days by providing cheap rides at the expense of venture capital dollars to acquire users. This growth hacking strategy worked and has since been copied by many tech firms, hoping that the products combined with cheap costs will create a network effect and retain users when they eventually discover ways to be profitable.

Now imagine if instead of giving cheaper rides, Uber gave out tokens to its early adopters, enabling them to become part of the community and get rewards for being active consumers of said product. For every ride that you order and for every ride that you pick (as drivers), you will receive rewards in UBER tokens.

It is safe to say that the majority of end-users, including the earliest adopters, will dump UBER tokens for cash unless there is a reason to hold them. In crypto, this usually means that the price of a token will be sacrificed, at least in the short term, to help bootstrap the project’s user base and achieve growth (DEX liquidity mining pool2).

It is also safe to assume that opportunistic actors will try to game the reward system and suck out as much short-term profit as possible. Granted, if the product is actually good, users will still stay (e.g. STEPN has more stickiness vs Axie Infinity), but this means that projects need to be able to balance their growth hacking strategies with good products and sustainable token distribution.

Oftentimes, projects try to achieve this balance by obfuscating the true use-cases of their tokens or creating a use-case to artificially delay the selling pressure instead of improving on their products or simply turning on value accrual mechanisms.

Even then, this doesn’t address the question: who will be eligible for the cash flow?

Can I submit a proposal to the Uber governance forum and turn on the fee switch so that UBER token holders get a part of the revenue?

Maybe — but if that’s the case, then what is the Uber equity used for?

If UBER token holders receive cash flows and have the power to govern the future of the business, then it should just be a tokenized Uber equity with more utilities, or else one of the assets is going to be rendered worthless.

Also, focusing too much on growth hacking instead of the product tends to produce unsustainable gamification mechanics or worse, ponzinomics — but that’s for a different post.

The Token Endgame is: Tokenized Equity

Surprise surprise.

Like it or not, for application layer projects, even if one is chain-agnostic, the endgame is to make your token as equity-like as possible. I don’t believe that value can accrue to both equity and tokens if both exist. This might be temporarily possible in an UpOnly environment, but when shits hit the fan, the tokens will be discarded first.

Some might argue that accruing value to both is possible if the tokens have proper “value accrual mechanics” — fancy-schmancy words, but all of the mechanics that might make your token have values will make it “equity-like” or render the equity useless. At that point, for god sake just pick one and decide.

So the next time you look at a project, ask yourself: do I actually “own” the project and the cash flow/governance associated with it, or am I simply a side piece.

Fortunately, some protocols are leaning more and more towards this direction whereby all value accrual is going to the token holders. But of course, they have to be careful in describing said mechanics to make sure that their tokens are not deemed as securities. Not. A. Dividend.

This is primarily the regulators’ fault. For the first time, crypto opened up a way to organize capital and run organizations in a truly global and decentralized manner. Not adapting to new technologies or trying to implement archaic laws will impede the growth of the space and cause mispricing in the crypto market.

I am, however, still positive that the regulatory frameworks will eventually catch up and be on the side of innovators. It might not start with the developed countries due to their self-interests, but we’ll eventually get there.

So What’s The Conclusion?

I’m no securities or legal expert but web 3.0 founders need to balance:

how “equity-like” their token is while making sure it’s useful

where to market & sell their token

create a truly remarkable product that people love even without the token

The token is not the product, but it needs to enhance the product.

Unfortunately, achieving decentralization via token is one of the easiest ways to claim that you’ve enhanced the product, but properly doing so might make your token too “equity-like”. So your best bet is most likely to target Emerging Markets where the laws might be more friendly and raise the majority of your capital from accredited investors and HNWs.

This also means that the true level of decentralization and incentives of a project will be tested. I’m a believer that it is not only about code, tech, or governance (such as who are multi-sig holders), but true decentralization also means who are the penultimate owners of the project and the recipient of the cash flow.

If I own 10% of Apple stock, even if the stock goes down by 50%, that still means that I own 10% of the company and everything that’s associated with that ownership. If I own 10% of UNI total supply, and the token goes down by 50%, what do I actually own…? (For now, it’s the promise of a future value).

Until owning a token becomes as simple as owning Apple, we have a long way to go.

Letting Go of Control

This past week, I caught Covid. I’ve been avoiding it like a ninja for the past two years but it eventually got a hold of me. I didn’t feel too much pain, but it still wasn’t enjoyable. As I was laying on my bed, I opened TikTok in an effort to stay relevant with the GenZ when I came across a beautiful post in which a guy responded to the question: “When have you felt your weakest?” with “when I started taking my current relationship seriously; if you’re trying to build something with another person, you need to drop the belief that you have full control over everything”. Crypto people are some of the most driven, hardworking, and ambitious cohorts that I’ve ever met. Oftentimes, these traits tie closely with having the belief that you have total control in life.

To foster my most meaningful relationships, I’m learning to let go of control.

Until next time,

Marco M.