Disclaimer, NFA, all that legal stuff: All the information presented on this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.

Hi folks 🙋🏻♂️,

It has been another gloomy week in crypto. The negative news doesn’t seem to be stopping. The week started with the SEC charging Kim Kardashian for promoting EthereumMax without proper disclosures — and it somehow snowballed into Binance Chain getting hacked for 9 figures, four DeFi exploits in the past day alone with Mango Market’s $100M exploit being the highlight, and the SEC launches its investigation to Yuga Labs (Bored Ape). Blame it all on the Kardashians.

Gensler's Crypto Superpower

For many years, people in crypto have been operating under the assumption that those who “get” crypto will eventually become proponents of the industry. After all, how can one be against decentralization and transparency? The premise of giving power back to the people, creating a more equitable financial system, and transferring trusts from our eroding institutions to immutable codes sounds like brilliant ideas. However, crypto is an incredibly cultish industry. If one isn’t careful, it’s extremely easy to fall into echo chambers, and there are many to choose from — ranging from Cardano maximalists to Bitcoin libertarian right-wing hardliners. As ugly as the previous sentence sounds, what’s most ironic is perhaps the echo chambers of builders that regurgitate the wild wild west spirit of decentralization and privacy without fully understanding how our world operates.

The most dangerous enemy is sometimes the one that’s closest to you. Nouriel Roubini and Peter Schiff are outsiders of the crypto space. They have bombastic personalities and might disagree with the spirit or value of crypto, but they’re not real concerns. They also have their own “narratives”. Just like how Michael Saylor is with Bitcoin, Schiff with Gold, and Nouriel with doomerism.

Gary Gensler is different. He was a practitioner at Goldman and taught crypto at MIT. He’s dangerous because he “gets” crypto, but he might not be fully on board with the ideology that it holds. Although the SEC sometimes made crypto remarks that turned heads in confusion, the point is that Gensler understands crypto a lot more than your typical crypto critiques that just spew talking points. One can be bullish on crypto and blockchain in general but believes that some form of restrictions is necessary, and in fact, good for the growth of the space.

This mentality is not that uncommon. I’ve seen it play out many times. Friends and former colleagues who are brilliant in their respective fields (finance, tech, business) have asked substantive questions that go against the “core ethos” of crypto. These people aren’t environmentalists that got caught by the “crypto is bad for the environment narrative” nor are they incumbents with personal interests to be against crypto. It’s quite simply that not everybody agrees the transfer of money or value should be fully governed by unchangeable sets of codes, with no possible intervention from the governments at all.

SudoSwap → AMM for NFTs, making the NFT somewhat fungible → royalty fee is a form of revenue share → NFT collections began reducing their royalty to zero → the SEC investigates Yuga Labs → coincidence? Trust your instincts.

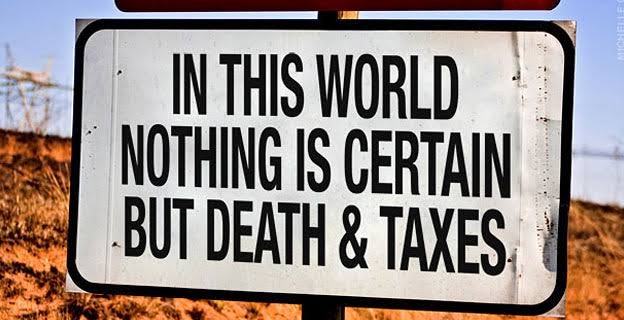

Governments, hence our society, function because of taxes. There needs to be a way for governments to understand the flow of money and charge taxes accordingly. This is a fact. This premise alone creates an argument that no matter how decentralized a financial system is; the very tail end of the chain-of-activities will be centralized. You might have made $10M in crypto via liquidity mining as an anon, but when you want to purchase a new house, a new car, or even a cup of coffee; you will interact with a system that enables the governments to be aware of your activity. Even in the very unlikely scenario where there’s a Point-of-Sales system that’s fully decentralized and private, the government can simply just ban it. If a government completely lets go of its control over money, it will cease to exist.

So what’s the future of crypto? With the way that things are developing, is crypto going to be a boring industry that gets regulated out of oblivion? In this piece, we break down why that’s not the case and explain how crypto will still unlock enormous potential given where things are going.

Here are the quick takeaways:

Somebody might “get” crypto, but not be fully on board with the ideology that it holds.

“Privacy” in the freedom of speech context and in a financial transaction context are two different beasts.

Absolute privacy is impossible to have a semblance of a normal life.

Security regulations are the primary issues; non-US jurisdictions have enormous opportunities if they know what to do.

Crypto’s superpower is liquidity reflexivity, which will experience exponential growth once the regulatory framework becomes clear.

A Hard Problem

Balancing freedom and privacy with order is hard. Social media giants with billions of dollars in resources are still struggling to solve this problem. It’s not a quantitative problem. Letting go of control over how a system operates and completely relying on the free market to regulate itself is as if letting every social media platforms become 4chan. It will either end up serving only niche users or get outcompeted by a more moderate platform such as Reddit.

In the crypto space, decentralization and privacy maximalists often say that the technology itself needs to get to the point where it’s completely immutable and uncensorable. We’ve touted this talking point when Tornado Cash was banned. Additionally, discussions surrounding Flashbots’ role and base layer censorship are developing as the space realizes that when governments get serious, it’s not easy to fight back. Let’s do a simple thought exercise and imagine a future where blockchain has scaled and on-chain privacy is the norm.

Hypothetically, a person can do the following:

Build a credential as an anon person on a decentralized social media platform

Get a job at a DAO full of anons

Get paid for contributing to the DAO

Allocate the salary to a mixer or a privacy-focused chain

Use the money to do private on-chain trades and make millions in the process

Then what?

When you want to use that money to eat, you need a way to tie it back to the real economy, and at that point, you’ll be traced by the centralized Point-of-Sales system that needs to report back to the government. Governments can easily say that merchants that don’t comply with this requirement can’t operate legally.

My point is that there’s no such thing as absolute privacy if you want to live a semblance of a normal life.

Sure, the Celsius doxxing situation is extremely stupid. People have the right to not disclose the full scale of their wealth. However, there are solutions to these specific problems even without the help of crypto. The majority of people who works for Facebook won’t even know if their colleagues secretly made $30M by going all-in on DOGE in 2020. We don’t need a crypto-specific solution to this problem — there might be demands from people who want to completely control and take custody of their own capital in private, but I doubt the TAM will be big enough.

Don’t get me wrong. There is enormous value to anonymity, but it’s not without its downside. Being an anonymous reporter fighting against an oppressive regime is different than being an anonymous crypto Twitter personality that wants to promote private on-chain transactions to pay fewer taxes. “Privacy” in the freedom of speech context and in a financial transaction context are two different beasts.

The ideal solution: a decentralized identity solution that keeps some sort of anonymity but enables tracing when necessary. Perhaps as ZK-proof tech improves, we’ll see an implementation of this idea. That said, it won’t be without trade-offs.

Liquidity Reflexivity

Crypto’s superpower is liquidity reflexivity. Having an internet-native way to transfer value with one another has exponentially increased the speed of capital flow. Since 2014, the crypto market has facilitated hundreds of trillions in transaction volume. In recent years, the crypto space has also been one of the most well-funded industries.

Perhaps the most obvious thing that needs to happen is clarity surrounding securities regulations. Alex’s tweet below only got 82 likes, but this is the key to unlocking crypto’s potential. The US currently has a monopoly in terms of securities regulations due to its standing as the world’s largest superpower and largest financial market. Other jurisdictions would benefit greatly if they can construct a framework surrounding securities regulations that enable founders to explicitly say that what they’re raising for is tokenized securities. To start, they might be able to simply ban US persons, which will create a brain drain for crypto builders in the US, potentially forcing US lawmakers to “act right” and not tread the water regarding this issue.

Crypto Will Thrive

Crypto’s superpower won’t go away even if the current regulatory climate continues. Although it might not be the “perfect outcome” for crypto proponents, we have to adapt and understand that this technology will still contribute so much to the world. It will unlock enormous value creation even if there are trade-offs that need to be made with the governments. Just like how the internet is neutral on some aspects and regulated on others, the same thing will need to happen to crypto before it will unleash all of its potentials.

Moving Forward

This past week, I sunsetted a daily newsletter that I was doing as a side project for 8 months. We published 246 issues and collected thousands of insightful data points, providing useful daily updates on all-things crypto for our readers. While consistency is key, understanding the market’s feedback: cutting your losses, and doubling down on what’s working is even more important. Three months ago, I started this publication. Instead of daily curated updates, it focuses on longer-form issues (7-12 minutes of reading time). I garnered 3x the number of subscribers and 10x the number of readers in under 3 months. It seems that, after being in the crypto space for close to six years, people do want to hear what I have to say instead of just curating the news.

Thus, I’m doubling down :)

Until next time,

Marco M.

The SEC knows crypto is a threat to their power base and they have to embrace it or risk getting left behind in crypto dust. Making a play to regulate it is logical. Get federal control and the SEC has a moat protecting them from crypto marauders.