Disclaimer, NFA, all that legal stuff: All the information presented on this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.

Hi folks 🙋🏻♂️,

I took a break last week hoping that things will move on by now and I’ll be able to write about intriguing topics such as decentralized social platforms, identity verification, and many more under-explored business models in crypto. Instead, the news cycle got more ludicrous by the day. The lack of governance and frankly just the level of stupidity that happened at FTX became increasingly worse with every new piece of information discovered. To make matters worse, a few days ago, we started hearing rumors that Genesis, the crypto lender and primer brokerage firm owned by Digital Currency Group (DCG), is facing potential bankruptcy. Fast forward a few days, more details came out and the likelihood is increasing as we speak. I’m tired of seeing another problem in crypto that’s caused by the same broken practice: related parties transactions — or how I like to say it: stop sleeping with your own sister.

DCG and Genesis: A Fiasco

Seventy percent of lottery winners go broke in five years or less. You must have heard of the previous sentence. It’s a common notion that those who suddenly got wealthy without experiencing setbacks and the necessary hard work to achieve it tend to let it all go. My father used to say, “easy money is money easily lost” — and a wealthy friend of mine who owns a family office once said, “The first generation makes it, the second generation spends it, and the third generation blows it."

We see clear examples of this. Corrupt politicians in developing countries are much more likely to live a lavish life, spending their money on their third wives’ fifth Hermès bag, and celebrating the New Year at The Brando Resort. On the other hand, a successful business person who comes from humble beginnings tends to be much more conservative with their capital. More so if these are atoms-based businesses, not bits. They truly realize the value of money.

Crypto can often “feels” like easy money. Don’t get me wrong, I don’t think there’s anything wrong with making a living via the capital market. The world’s financial system is one giant shady system itself, but that’s for another post. The problem starts when those who capitalized on the easy money began affecting other businesses because of market dynamics. VCs did no or minimum diligence on FTX because they had to get that deal flow and generate returns, that’s their responsibility towards their Limited Partners. Lenders did minimum diligence and underwrite ludicrous loans to 3AC because there are only a few large names in crypto, and they need the revenue.

Alameda (hence FTX) and 3AC made most of their profits via “easy money”. DCG and Genesis are not really that. Their businesses are much more conventional, but they failed to realize how badly “easy money” can affect their business.

In this piece, we discuss how Genesis has been on the receiving end of easy money hubris and insolvency—from losing $1 billion+ to 3AC, and now another $200M to FTX—and what implication this might potentially have for the broader crypto market.

Here are the quick takeaways:

Genesis is one of the largest and most notable crypto lenders and primer brokerage firms — its demise will be catastrophic for the market.

DCG and Genesis have been doing related parties transactions, a move that can be done right, but has historically shown to be a bad practice to adopt.

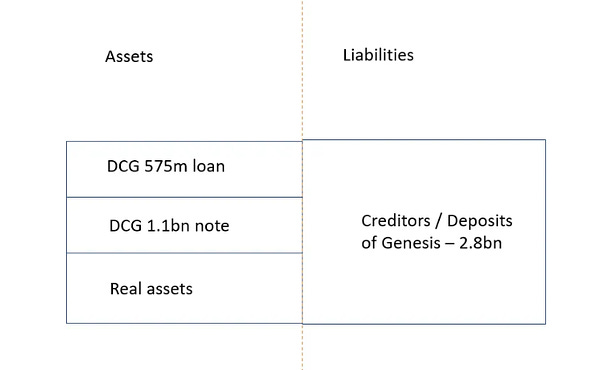

DCG owes Genesis $1.5 billion+ in loans.

If DCG is forced to unwind Grayscale’s GBTC product, 600,000+ worth of BTC ($9-10 billion) will be hitting the market.

Genesis is likely done, but DCG will survive.

How did we get here?

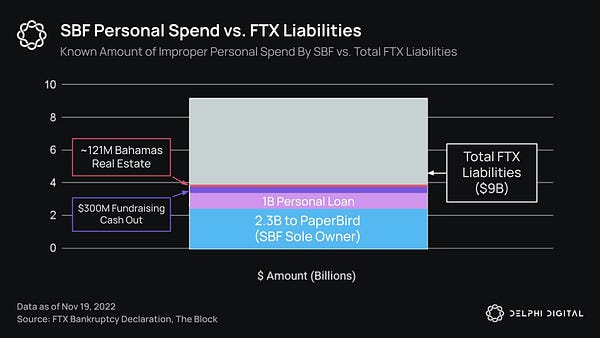

Let’s take a step back and recap what has happened since the FTX shenanigan two weeks ago. The answer: more shenanigans. This tweet from Delphi neatly summarizes the level of ridiculousness that is starting to uncover. The most important new piece of information: Genesis has $175M stuck on FTX.

Here’s a quick timeline from Cred. I’m always incredibly annoyed when companies conduct such terrible crisis management. Yes, admitting their balance sheet hole right off the bat might’ve sparked more panic, and there’s no easy middle ground to properly convey your trouble, but it feels like no one ever learns.

By November 23rd, speculations surrounding how the problem might not stop at just Genesis, but might also affect its parent company, DCG, have been circulating around the internet. To address this, Barry Silbert, Founder, and CEO of DCG released a statement to shareholders.

A few things are confirmed thanks to this statement.

DCG owes $1.5 billion+ to Genesis.

~$500M is due in 6 months, and the remaining $1 billion+ is due in 2032 (yes, that’s not a typo).

Unless Barry successfully raises fresh cash, any last-mile options that he has to repay back the money will most likely result in more downward pressure for the crypto market.

Half a year of GBTC fees is approximately $100M.

They can sell some GBTC to pay the $500M.

Sell other port co with revenues.

Regardless, Genesis seems to be in a lot of trouble as it has hired a restructuring adviser.

Related Parties Rehypothecation

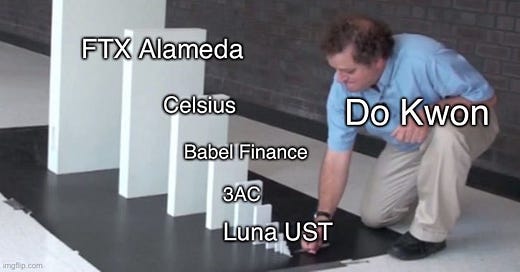

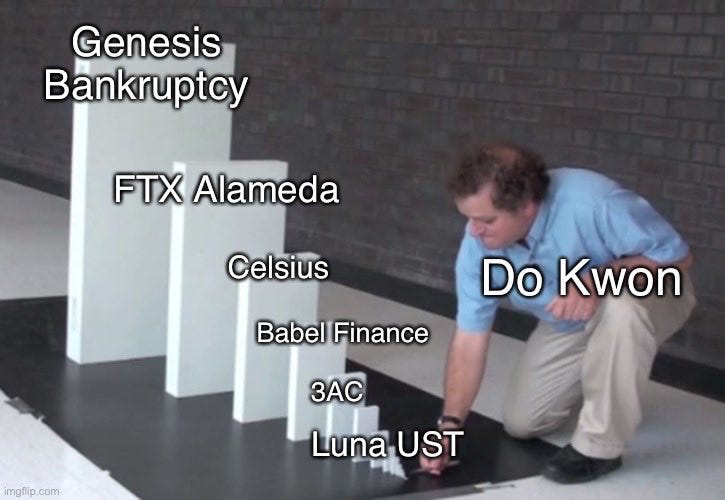

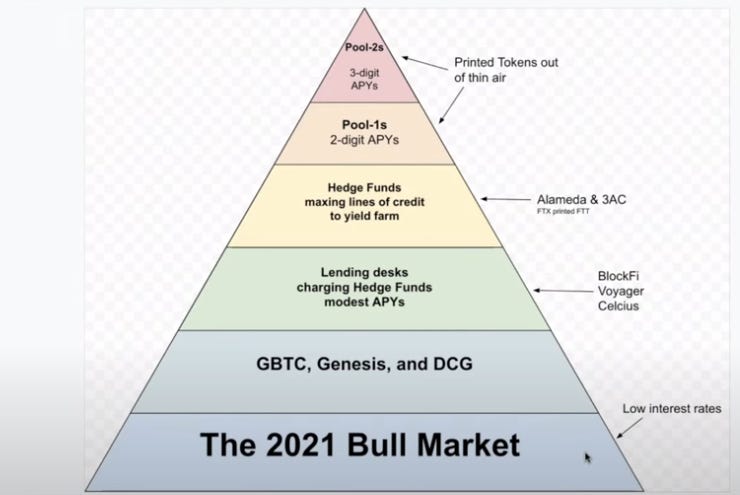

It seems that every single problem in crypto in the past year is predicated on the same issue, rehypothecation between related parties, sprinkled with excessive leverage, hubris, and the money printer being taken away. The Bankless guys provided an interesting chart to explain how crypto yield was generated in 2021.

Additionally, @DataFinnovation published an amazing investigative piece in June 2022 about the potential relationship between 3AC and DCG. It deserves a full read on its own but here’s a high-level summary.

It seems like 3AC borrowed BTC from Genesis, then pledge the BTC back to create Grayscale’s GBTC shares.

3AC then uses this GBTC as collateral to borrow more capital from Genesis.

This enables 3AC to loop and lever up their capital significantly.

The strategy made sense to 3AC because GBTC had a premium instead of a discount, creating “free money” for 3AC.

Things went south when GBTC premium reverted into a discount combined with the aftereffect of LUNA implosion.

3AC can’t pay back its loan because it lost its borrowed money in LUNA.

3ACs’ GBTC collateral got margin called.

DCG stepped in and started buying GBTC to prevent a larger discount and to avoid a systemic collapse.

Genesis lost too much money in the collapse because 3AC can’t pay back its loan, DCG “saved” Genesis, but the FTX collapse happened, which hurt Genesis further, requiring DCG and Genesis to seek external funding in order to maintain their businesses.

bruh…

Learning Experience

Borrowing from related parties. Rehypothecating capital unnecessarily. Excessive margin. Disastrous corporate governance. Greed and hubris. Once again, crypto has proven times and times again that it’s able to recreate all of the disasters that previously plagued the traditional financial system at a lightning pace. To be honest, one of the best experiences that one would get by working in crypto is that you get to learn all of the crazy financial tricks that people are willing to do for a quick buck, much faster than if you simply dabble in traditional finance.

Moving Forward

I think the crypto industry needs to think about where we’re going next — and what’s the actual future of this space. This is even more important if you’re a professional working in the space. I’m not writing the last two sentences to spark fear. In fact, I had these moments of doubt in 2018 and again in 2020. These days, I no longer have any doubts. What helped me achieve such certainty and confidence for the future of this space is by mapping out, in great detail, the various potential outcomes of the crypto industry. This not only includes the benefits and talking points that VCs would spew during the bull market, but also what would happen if government regulations become increasingly hostile, and so on. I can say with certainty that even if all of that happens. This space is here to stay. I have a feeling, I might need to dedicate a full post on that soon.

Until next time,

Marco M.