Building a Layer 1 Is Hard

Aptos fumbles and why a killer app wins over L1.

Disclaimer, NFA, all that legal stuff: All the information presented on this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.

Hi folks 🙋🏻♂️,

What a messy week it has been for crypto. If last week’s theme was exploits, this week’s seems to be regulatory scrutiny. Reuters published an investigative piece on Binance, Visa & Mastercard drew government scrutiny over crypto-linked debit cards, and Sam Bankman-Fried is being investigated by the Texas securities regulator. I always tell people that when every piece of news sounds bad, it’s a sign that we’re nearing the bottom.

Today we’re covering Aptos, the new L1 blockchain darling of Silicon Valley and VC firms. Aptos launched its mainnet and it has been a clown show thus far. Let’s get straight into it.

Building a Layer 1 Is Hard

Aptos is a new L1 blockchain with $350M+ in total funding. It was created by former Meta employees, Mohammad Shaikh and Avery Ching, who previously worked on Meta’s failed stablecoin project. Aptos is valued at $4 billion pre-launch, even in the current macroeconomic environment. Honestly, props to them. Three months after it’s Series A, Aptos launched its mainnet, which went live on October 17, 2022. Thus far, it hasn’t been a good day on Crypto Twitter for the Aptos team.

In crypto, it’s almost always easier to fix the tech than to fix the community. Aptos needs to double down hard on its community management, communication, and transparency after the level of incompetency that it shows during the first week.

So what’s going on with Aptos and why is building a new Layer 1 blockchain network extremely difficult? In this piece, we break down everything that has been happening with Aptos in the past 48 hours and explain why crypto development often has the wrong focus.

Here are the quick takeaways:

Ultimate transparency is the bedrock of crypto because of its community-first component — Aptos didn’t do a good job.

Replicating the grassroots organic growth and network effect of Ethereum (and other successful L1) is difficult.

Historically, there hasn’t been a lot of successful L1s when we consider the amount of time, effort, and capital associated with the protocols.

Founders might have a better chance of finding product-market fit building application layer projects.

Top protocols with PMF are considering transitioning into their own appchains.

Outright Recklessness

In the past 48 hours alone, there have been multiple unprofessional practices from the Aptos team. I think the last sentence is pretty charitable given Aptos’ caliber of a project. Here are some highlights and top tweets.

Unclear Tokenomics.

The very basic thing that any crypto project with a token needs to get right is being 100% transparent about its token. This includes token supply distribution, use cases, mechanisms, and much more. Aptos launched without official tokenomics documentation, although they eventually posted it after much criticism from Crypto Twitter, and after a leak from Upbit.

Unclear Communication.

Aptos did not make it clear that the Genesis of its chain occurred on October 12, five days before the “official” mainnet launch. This was eventually clarified by its CEO but required many deliberations from the Crypto Twitter community to figure out prior to the official announcements. Large entities are already staking beforehand.

Aptos enables vested tokens to be staked and for the subsequent staking token rewards to be liquid. With more than 80% of the current supply staked at a 7% yield, there are approximately 56 million APT tokens (80% * 1 billion total supply) released annually into the market — or roughly equivalent to $350M+ of annual sell pressure at $7 per APT.

Confusing Terminologies.

Aptos stated that 51% of its tokens are for the “community”. However, the word community here means a split between the Aptos Foundation and Aptos Labs, indicating that the only way coins will ever get into the hands of the “community” is if the Aptos Foundation or Labs allow it to happen.

Airdrop Issues.

Aptos conducted an airdrop without proper mechanics, enabling the opportunistic actor to launch a Sybil attack. Aptos also mandated some form of web 2.0 log-in or identification (Google, Discord, or GitHub) in order to be eligible for the airdrop.

Postponing Perpetuals.

When a project has to ask a major centralized exchange not to list the perpetual contract of its token, it’s an indirect admission of an imbalance token supply design. Aptos knows that market participants will take advantage of the unclear tokenomics (at least it was unclear at the beginning), and the fact that staking rewards are liquid.

Solana Is an Anomaly

A lot of people seem to forget that betting on the new L1 has always been the biggest game in town. There are ludicrous financial incentives for founders and investors to fund L1 because of its TAM and the amount of capital they can rack up without ever needing to achieve success in any sort of meaningful and sustainable way. You can have years of runways, practically wait out the Fed interest rate cycle, and raise more capital as needed. However, there have not been many successful L1.

Solana’s success was unique and an anomaly. Many VCs unsurprisingly want to replicate Multicoin’s and SBF’s 10,000% return with Solana, but history has shown that investing in L1 is hard. Multicoin had its losses with EOS, and there were multiple other L1 projects of the 2017-2018 era that never really made a return (NEO, ICX, and ZIL; to name a few). Even if you have a massive war chest, there are external components that can make or break an L1. Oftentimes, the amount of work and impact that the team behind L1 can put into these external factors are limited. Nurturing an organic community, a cult-like following, and a niche sector within the space is not just about spending capital. EOS raised billions but failed to produce the same level of outcomes as Solana. Other well-capitalized L1 in the past few years are making strides, but have not achieved any traditional form of success in any meaningful way when you consider the amount of capital raised.

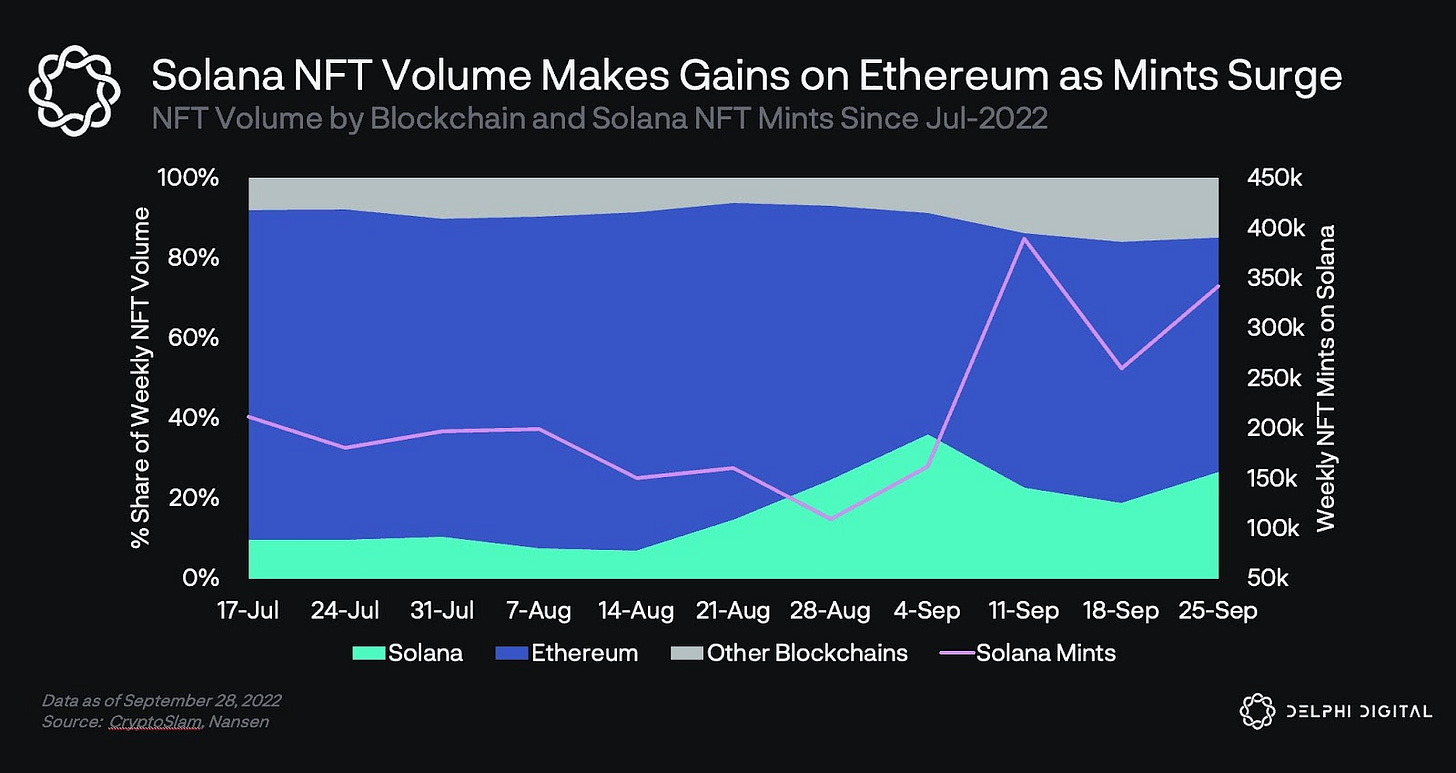

L1 also needs to ride a wave or at least put a strong focus on and dominate one aspect of the crypto space. Solana rode the NFT wave. What wave is there right now?

Additionally, unless you’re exceptionally well connected and have the appropriate background to launch a new L1, founders are better off finding product-market fit with application layer projects. Successful protocols with PMF, such as Axie and dYdX are considering transitioning into their own appchain to have improved performance and greater customizability. It seems like we’re moving more and more into a world where a successful dApp can just pivot to another L1 or become its own appchain, whereas a successful L1 needs to ensure the successful dApps stay on their chain — anyway, that’s for another post.

The Wrong Focus

Developing a new L1 from scratch is extremely difficult. You’re not only building a product, but also an ecosystem and a community in a decentralized open-source world without any Intellectual Property defensibility. Any work that you put out there can be replicated and duplicated by other entities. All of this while you need to focus on garnering developers’ interest, creating a thriving community, and attracting end-users to your ecosystem. Compare this to a dApp or an appchain, where the customer acquisition focus is much simpler: focus on the end-users.

Although we will most definitely see a multi-chain future, the majority of crypto users have shown that they don’t care about idealistic differentiators. They simply want to use the best product or the one that can make them the most money. The rise of new L1s has shown that we’re missing the point on what actually matters. We need a much stronger focus on building tangible, usable apps for everyday crypto users — instead of competing for the same existing market over and over again.

Atoms and Bits

In crypto, we often focus on bits but forget about atoms. The markets love bits-based companies when the macro environment is risk-on, and vice-versa when it’s risk-off. Despite the growth of blockchain technology in the past few years, the significant majority of crypto is still only focusing on bits. Sure there are projects such as Helium that have physical devices in their business model, but there aren’t many. I believe for crypto to reach $5 trillion in market cap during the next cycle, we need more focus on building atoms-based crypto businesses, ranging from a crypto-native point of sales system to mobile phones, and many more. The strongest tech company in the world is Apple. It’s both atoms and bits. With a flip of a switch, Apple decimated billions of dollars in value from Google and Meta advertising business. For crypto to truly thrive, the industry needs more companies that deal with atoms.

Until next time,

Marco M.